Welcome to part 2. (Click here to read the first part) I will begin this part with the modern panacea for recession. Loosen monetary policy, let your currency depreciate boost your export and plough back out of recession.

This looks efficient as well as effective in most cases. Although the sanity of increasing liquidity in the market was not suggested to the Asian tigers or the Argentinean government during the crisis, still it is now a well established fact to do so in order to fight recession. However, it might not give its usual results when we look at America.

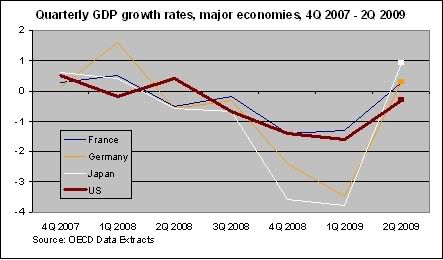

The USA is a net importer with huge trade deficit and USD is the global trade currency. Many other countries are dependent hugely on trade with the USA and also dependent on the value of USD. This has propelled most of the developing countries to maintain the value of their domestic currency against dollar to keep them competitive in the export market and also to prevent losing the value of their forex reserves. These nations which include the likes of China, Russia and India, have chosen domestic inflation over stronger local currency (Click here to better understand this phenomenon). Another factor which plays a role in keeping the dollar strong against other currency is that US lies in the centre of today’s mono polar world. Thus no major economy across the world stays untouched from US recessions. You can see on the graph how Euro area follows US GDP growth rate.

What this means for the US economy is that when monetary policy is loosen in times of recession, USD doesn’t lose as much value as expected and thus  US gains no particular advantage in the export market. Thus US gets no better at successfully targeting the foreign demand and it rather needs to prop up domestic demand to recover from recession. In the first part we talked about the interaction of domestic demand and expansionary monetary policy where there is an emergence of a catch 22 situation. (Are we seeing a similar phenomenon now? When there is liquidity in market and the proof is asset prices are increasing, stock market all over the world is on their way up, Gold is at its all time high; though the queue outside employment offices in US isn’t decreasing at the same rate, which emphasises that money available is being invested in assets rather than production.)

US gains no particular advantage in the export market. Thus US gets no better at successfully targeting the foreign demand and it rather needs to prop up domestic demand to recover from recession. In the first part we talked about the interaction of domestic demand and expansionary monetary policy where there is an emergence of a catch 22 situation. (Are we seeing a similar phenomenon now? When there is liquidity in market and the proof is asset prices are increasing, stock market all over the world is on their way up, Gold is at its all time high; though the queue outside employment offices in US isn’t decreasing at the same rate, which emphasises that money available is being invested in assets rather than production.)

The democrats in US are currently using a mix of fiscal and monetary policy to provide stimulus to the economy. But the majority money till now has gone into saving the collapsing financial system which in turn used the money to write off bad debts. The road from here on would need a script for creating more jobs and stimulating demand. Let’s see what US does now, keeping in mind that USD hasn’t lost much against other major currencies. Will the expansionary monetary policy be used again or the fiscal policy will get its due? With interest rate already near 0% there is not much scope left here!

Money and demand are only two of the prerequisites for production to expand. Also needed are an appropriate labor supply, raw materials, infrastructure, and whatever else I can't think of. If any one of these essentials is lacking there will be no growth.

ReplyDeleteIt follows that tightening money can crush a vigorous economy, but if a moribund economy is suffering from anything other than a lack of money, cheap money can't revive it.

Why not? Our current recession was triggered by the disappearance of money, so why can't it be reversed by supplying money? Because once the economy has slumped for lack of money, its parts collapse with it. If your business depends on suppliers who have also retrenched, you can't just rev up again. If demand is low because other businesses are paying their employees less, you can't create enough demand just by restarting your own. Supplying more money gets to nothing but a liquidity trap.

My point is this. An economic system is a very complex organism, and trying to medicate it by adding or removing money alone is no more likely to succeed than trying to cure human ailments by bleeding the patient.